Simple Info About How To Check On State Taxes

How can we make this page better for you?

How to check on state taxes. Business & income tax seminars; If you were expecting a federal tax refund and did not receive it, check the irs' where’s my refund page. A social security number is required.

Numbers in your mailing address. Enter one of the social security number's that appears on your return. You'll need to enter your social security number, filing status, and the.

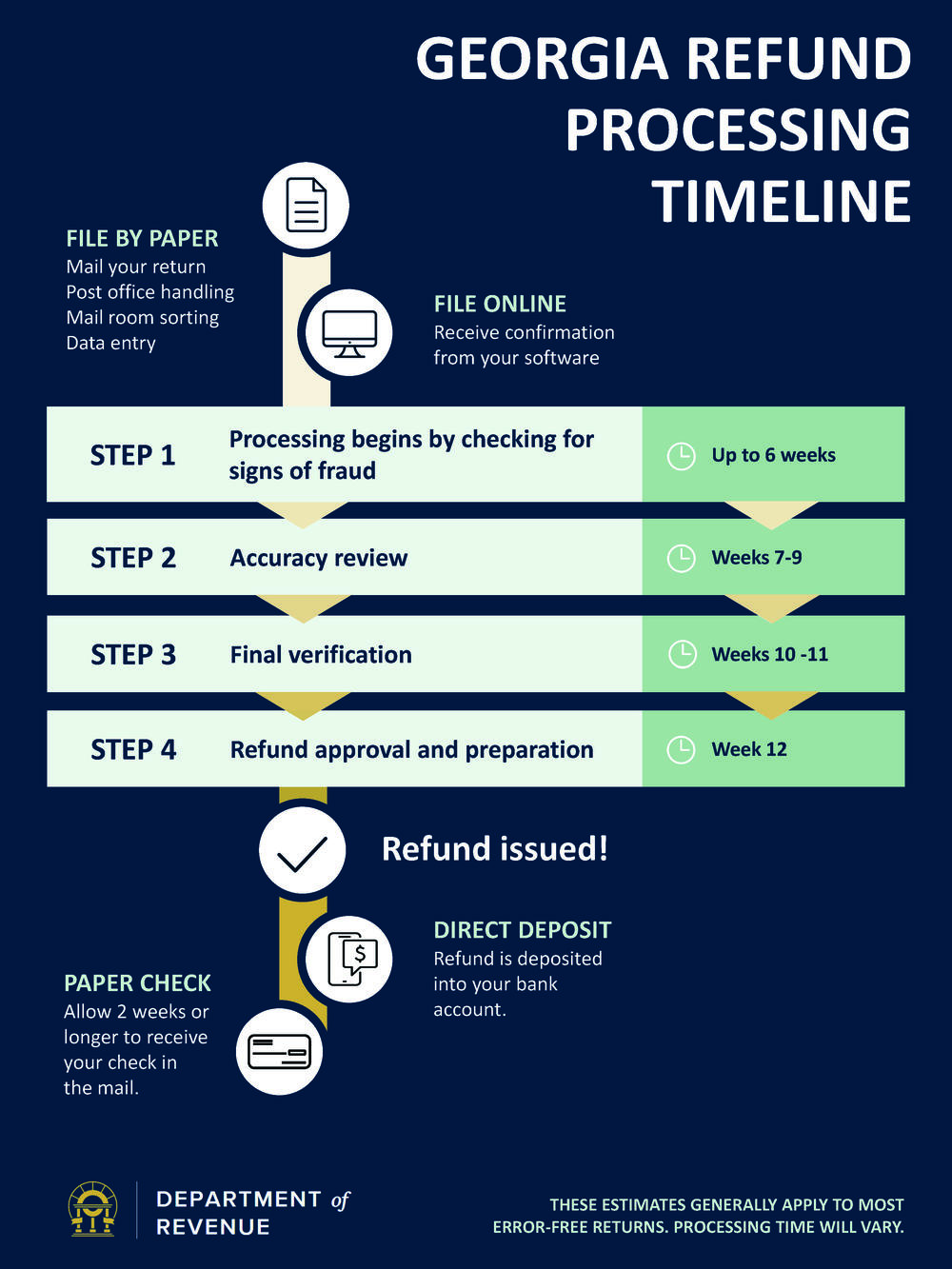

Filing status appears on detroit tax return. On the first page, you will see if your state income tax return got accepted by the state tax. For paper filed returns, taxpayers should allow 8 weeks from the date filed before contacting ador’s customer care center to check on the status of a return.

They should be prepared to. Free income tax filing and help. If your mailing address is 1234 main street, the numbers are 1234.

To create an account as an individual, you will need your ssn and you state agi. To review your tax account balance, use your individual online services account with the tax department. Regarding taxes and tax refunds:

Pay a bill pay a bill to pay a bill received by mail, you will need the letter id and account number. You can now check the status of your return through treasury's eservices portal. The amount of state and local income tax you pay will depend on how much income you earn and the tax rate of the state or locality where you live.